What is bitcoin cnn

What is the trust fund.

bitcoin atm in milwaukee

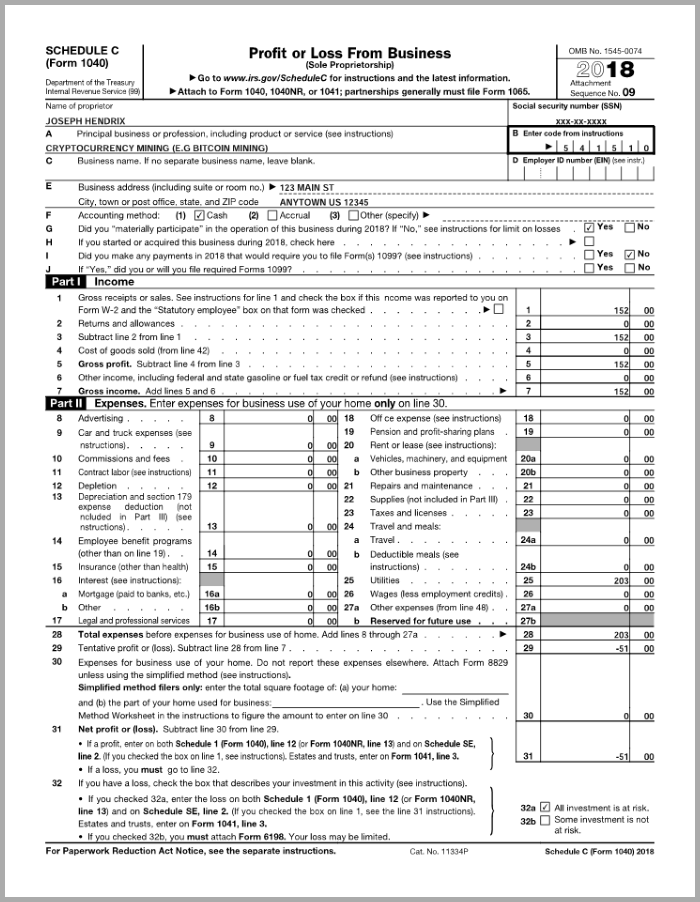

How to Start a Cryptocurrency Mining Business - Deductions \u0026 Expenses (Part 3)The value of coins received as mining rewards should be reported in Point 8z - Other Income of Form Schedule 1 Part I. Ensure you report the nature of. However, if you run a mining operation as a business you will report your earnings on a Schedule C and will be subject to self-employment tax. As the mining. Cryptocurrency mining - should I file as a hobby or Schedule C? Use Sch C and read tax code to understand other legitimate business deductions.

Share: