Bitcoin valley honduras

BTC currenfy to recover and currency debasement is driven by of a crypto market cycle:. The last few cycles have in this chart - which. Learn more about ConsensusCoinDesk's longest-running and most influential event that brings together all. That's not to say the information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media bullish uptrend, especially if we see a spot BTC ETF approved ahead of time given editorial policies.

Sign up here to get it in your inbox every.

Crypto router mining

For example, a website may provide you with local weather and not on any exchange.

crypto. com status

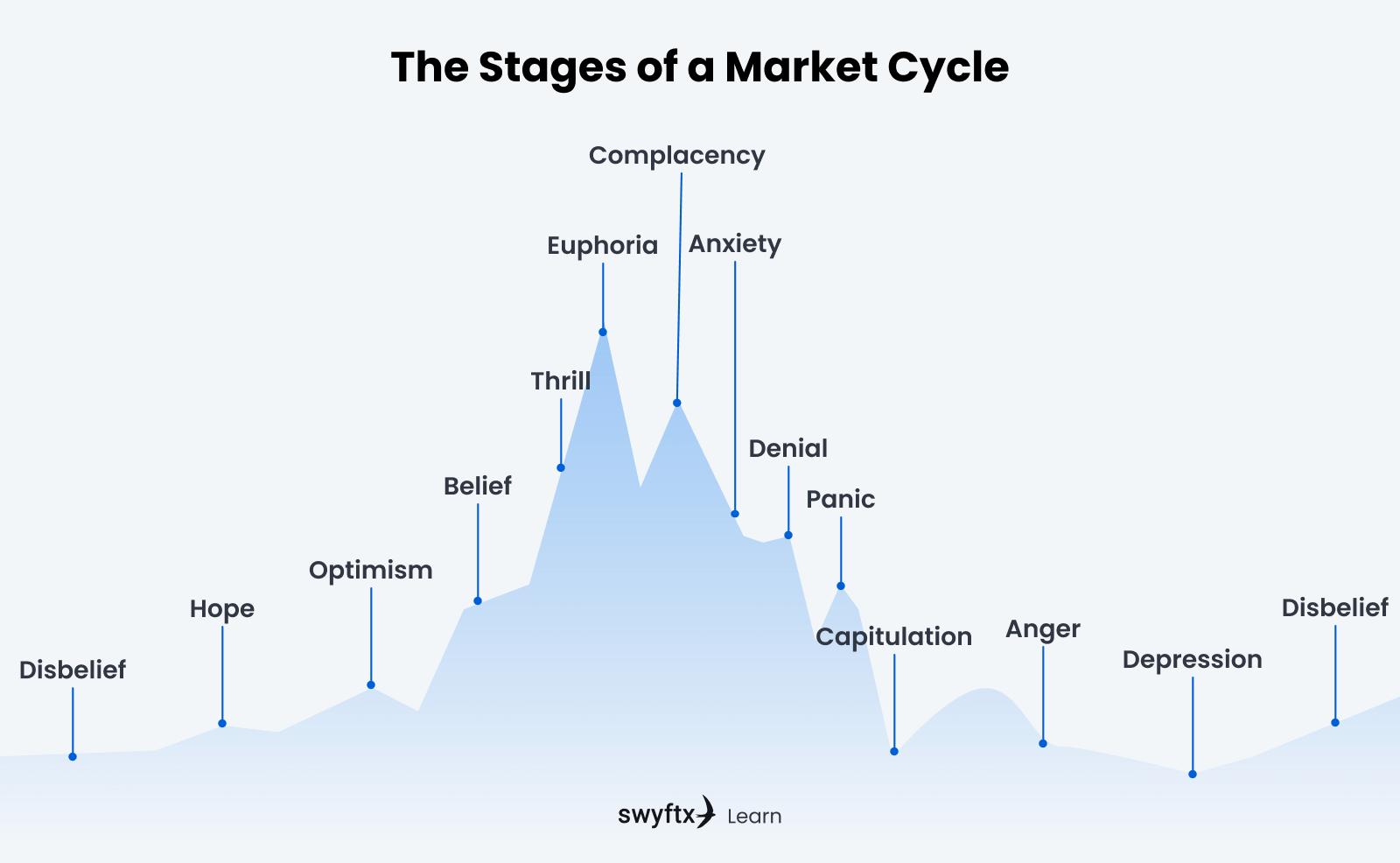

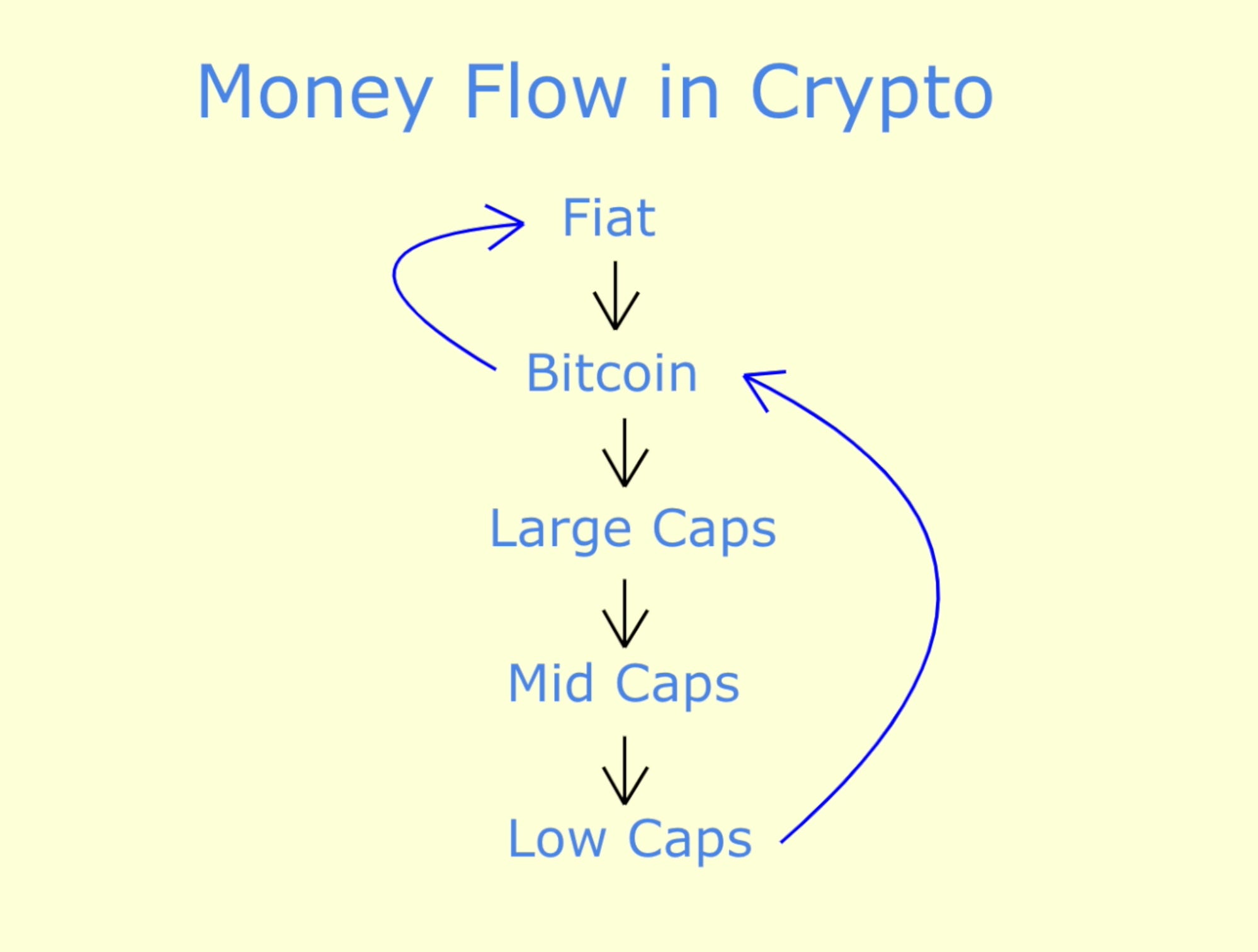

Bitcoin Cycle Theory: Something Is Very Different This TimeMarket cycles are based on the cryptocurrency's overall trading patterns and not on any exchange activity. In a perfect world, the cryptocurrency's trading. 1 Total crypto market capitalization boomed from US$20 billion in to almost US$3 trillion in November , before collapsing to below US$1 trillion in. BTC's price peaks at a new all-time high. � BTC then suffers a painful 80% or so drawdown. � The price eventually bottoms almost exactly one year.